5 Key Actions To Secure A Private Credit Role

Table of Contents

Master the Fundamentals of Private Credit

A strong foundation in private credit principles is paramount. This isn't just about possessing theoretical knowledge; it's about demonstrating practical expertise. Prospective employers in private equity, investment banking, or secured lending firms look for candidates who deeply understand the intricacies of private credit.

-

Gain expertise in financial modeling: Mastering discounted cash flow (DCF) analysis and leveraged buyout (LBO) modeling is crucial. These are the cornerstones of evaluating private credit opportunities. Practice building models from scratch and interpreting the results accurately.

-

Understand different private credit structures: Familiarize yourself with various debt structures, including unitranche, senior secured, subordinated debt, mezzanine financing, and other alternative credit instruments. Understanding the nuances of each structure is essential for effective credit analysis.

-

Develop proficiency in covenant analysis and debt structuring: Learn to critically analyze loan agreements, identify potential risks, and understand how debt is structured to mitigate those risks. This is a critical skill for credit analysts and underwriters in the private credit space.

-

Familiarize yourself with industry-specific regulations and compliance requirements: Private credit operates within a complex regulatory environment. Understanding these rules is crucial for mitigating legal and operational risks.

-

Study successful case studies and market trends in the private credit space: Stay informed about recent transactions, market trends, and the performance of different private credit strategies. This will help you demonstrate a practical understanding of the industry's dynamics.

Network Strategically Within the Private Credit Industry

Networking is not merely a helpful strategy; it's a necessity in the private credit world. Building strong relationships within the industry can open doors to unadvertised opportunities and provide invaluable insights.

-

Attend industry conferences and events: These events provide excellent opportunities to connect with professionals, learn about new trends, and expand your network. Target conferences focused on private credit, leveraged finance, and alternative investments.

-

Utilize LinkedIn to connect with professionals in private credit: Actively engage with professionals on LinkedIn. Join relevant groups, participate in discussions, and reach out to individuals for informational interviews.

-

Conduct informational interviews with professionals in your target roles: Informational interviews are invaluable for gaining insights into specific roles, companies, and the industry overall.

-

Seek out mentorship opportunities from experienced private credit professionals: A mentor can provide guidance, support, and valuable advice throughout your career journey.

-

Join relevant professional organizations (e.g., CFA Institute, ACG): Membership in these organizations provides access to networking events, educational resources, and valuable professional connections.

Craft a Compelling Resume and Cover Letter

Your resume and cover letter are your first impression. They need to showcase your skills and experience effectively to secure an interview. In the competitive world of private credit, a generic application won't cut it.

-

Tailor your resume and cover letter to each specific job description: Highlight the skills and experiences most relevant to the specific role and company.

-

Quantify your accomplishments using numbers and data: Instead of simply stating your responsibilities, quantify your achievements using metrics and data to demonstrate your impact.

-

Highlight relevant skills such as financial modeling, credit analysis, and industry knowledge: Use keywords from the job description to optimize your application for applicant tracking systems (ATS).

-

Showcase your understanding of private credit through projects or coursework: Mention any relevant projects, coursework, or extracurricular activities that demonstrate your knowledge and interest in private credit.

-

Use a professional and visually appealing format: Your resume and cover letter should be easy to read and visually appealing, showcasing your attention to detail.

Ace the Private Credit Interview

The interview stage is your opportunity to showcase your personality, skills, and understanding of private credit. Thorough preparation is essential.

-

Practice answering common behavioral and technical interview questions: Prepare for questions about your experience, strengths, weaknesses, and your understanding of private credit concepts.

-

Prepare for case studies that assess your analytical and problem-solving skills: Practice working through case studies that simulate real-world scenarios in private credit.

-

Research the firm and interviewer thoroughly: Demonstrate your knowledge of the firm's investment strategy, recent transactions, and the interviewer's background.

-

Demonstrate your passion for private credit and your understanding of the industry: Show genuine enthusiasm for the industry and your desire to contribute to the firm's success.

-

Ask insightful questions to show your genuine interest: Prepare thoughtful questions to demonstrate your engagement and curiosity.

Continuously Develop Your Skills and Knowledge

The private credit landscape is constantly evolving. Continuous learning is essential to remain competitive and relevant.

-

Pursue relevant certifications (e.g., CFA, CAIA): These certifications demonstrate your commitment to professional development and enhance your credentials.

-

Take online courses or workshops to enhance your skills: Explore online courses focusing on areas such as financial modeling, credit analysis, and private credit strategies.

-

Stay updated on industry trends by reading relevant publications and attending webinars: Keep abreast of the latest developments, transactions, and market trends.

-

Actively seek out opportunities for professional development and growth: Look for opportunities to expand your skills and knowledge through further education, training, and networking.

-

Participate in relevant online communities and forums: Engage with other professionals in the field to share knowledge and insights.

Conclusion

Securing a private credit role requires dedication and strategic planning. By mastering the fundamentals, networking effectively, crafting a compelling application, acing the interview, and committing to continuous learning, you significantly increase your chances of landing your dream private credit role. Start implementing these actions today to advance your career in private credit and unlock the exciting opportunities within this dynamic field.

Featured Posts

-

High Stock Market Valuations Bof As Case For Why Investors Shouldnt Panic

Apr 27, 2025

High Stock Market Valuations Bof As Case For Why Investors Shouldnt Panic

Apr 27, 2025 -

Pne Groups Wind Energy Portfolio Expansion Two New Projects Added

Apr 27, 2025

Pne Groups Wind Energy Portfolio Expansion Two New Projects Added

Apr 27, 2025 -

Ariana Grandes New Dip Dye Ponytail Swarovski Campaign Unveiled

Apr 27, 2025

Ariana Grandes New Dip Dye Ponytail Swarovski Campaign Unveiled

Apr 27, 2025 -

La Fire Disaster Price Gouging Concerns Raised By Selling Sunset Star

Apr 27, 2025

La Fire Disaster Price Gouging Concerns Raised By Selling Sunset Star

Apr 27, 2025 -

Alberto Ardila Olivares Garantia De Exito En Tus Objetivos

Apr 27, 2025

Alberto Ardila Olivares Garantia De Exito En Tus Objetivos

Apr 27, 2025

Latest Posts

-

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025 -

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025 -

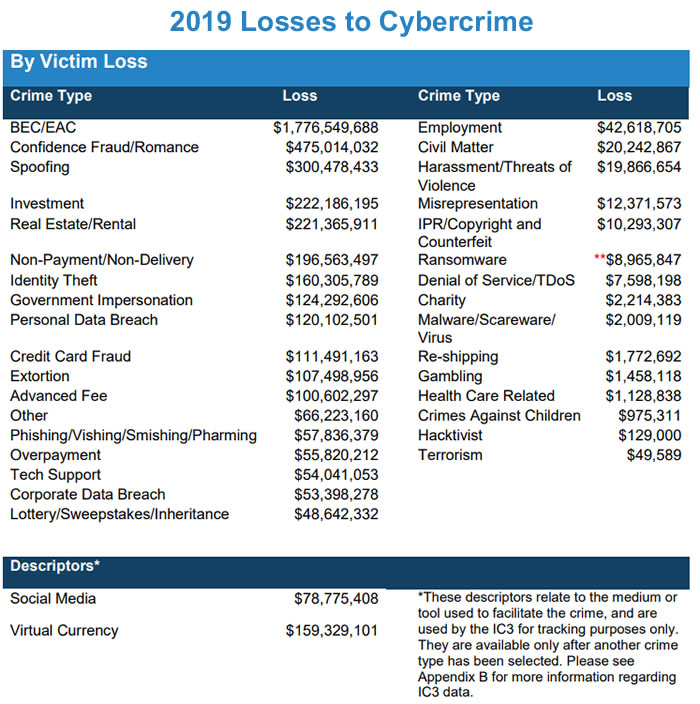

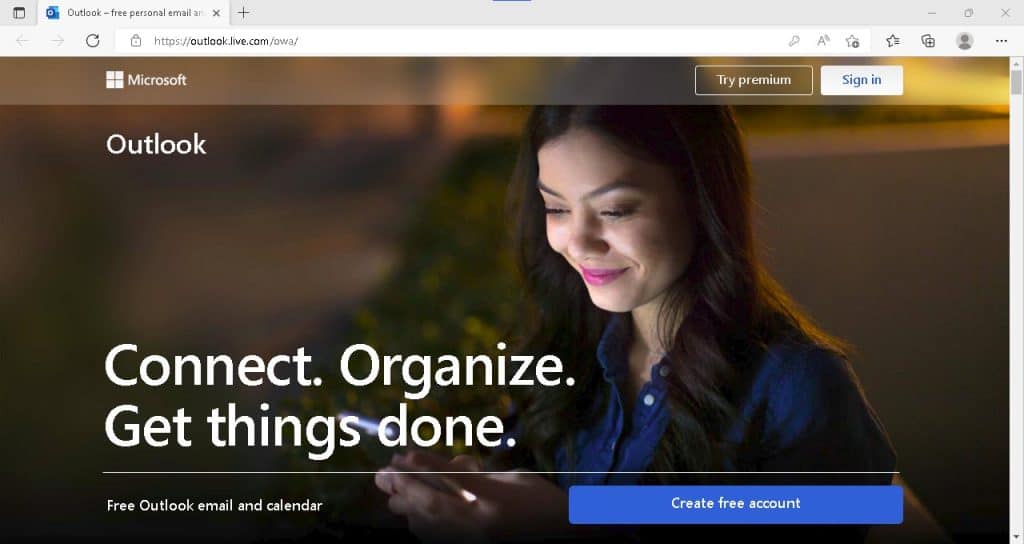

Individual Charged With Millions In Losses From Office365 Executive Account Hacks

Apr 28, 2025

Individual Charged With Millions In Losses From Office365 Executive Account Hacks

Apr 28, 2025 -

Massive Office365 Executive Account Compromise Results In Multi Million Dollar Loss

Apr 28, 2025

Massive Office365 Executive Account Compromise Results In Multi Million Dollar Loss

Apr 28, 2025 -

Cybercriminal Made Millions Targeting Executive Office365 Accounts

Apr 28, 2025

Cybercriminal Made Millions Targeting Executive Office365 Accounts

Apr 28, 2025