Analysis: Palantir's 30% Decline And Future Prospects

Table of Contents

Understanding the 30% Stock Decline

The 30% plummet in Palantir's stock price is a complex issue stemming from a confluence of factors. Let's break down the key contributors:

Macroeconomic Factors

The recent decline in Palantir's stock price is intertwined with broader macroeconomic trends impacting the technology sector. Rising interest rates implemented by central banks globally to combat inflation have significantly increased borrowing costs, making growth stocks like Palantir less attractive to investors. This is because higher interest rates increase the opportunity cost of investing in higher-risk, growth-oriented companies.

- Increased investor risk aversion: Investors are shifting towards more conservative investments in the face of economic uncertainty.

- Reduced appetite for growth stocks: Growth stocks, often valued on future potential rather than current profitability, are particularly vulnerable during periods of rising interest rates.

- General market volatility: The overall market volatility has amplified the impact of negative news on Palantir's stock price.

The poor performance of the S&P 500 and various tech sector indices further underscores the challenging macroeconomic environment contributing to the Palantir stock decline.

Palantir's Financial Performance

Analyzing Palantir's recent financial reports reveals a mixed picture. While the company has demonstrated revenue growth, its profitability margins and cash flow may not have met investor expectations. Scrutiny of key financial metrics is crucial for understanding the recent downturn.

- Revenue growth: While revenue has shown growth, the rate of growth might be slower than predicted, impacting investor confidence.

- Profitability margins: Profitability margins are key indicators of a company's efficiency and financial health; any significant decrease can lead to investor concern.

- Cash flow: A healthy cash flow is essential for sustained growth and investment; any negative trends in cash flow can negatively influence the stock price.

- Debt levels: High debt levels can make a company vulnerable during economic downturns. Assessing Palantir’s debt-to-equity ratio is important.

A detailed comparison of Palantir's performance against its own previous quarters and against industry benchmarks is necessary for a complete understanding of its financial health.

Competition and Market Saturation

The data analytics market is becoming increasingly competitive, with established players and new entrants vying for market share. This competitive landscape, coupled with potential market saturation in certain segments, presents challenges for Palantir.

- Key competitors: Palantir faces competition from established players like Microsoft, Amazon, and Google, along with specialized analytics firms.

- Market share dynamics: Changes in market share dynamics, indicating a potential loss of market position, can contribute to investor concerns.

- Emerging technologies: The rapid evolution of technologies like artificial intelligence (AI) and machine learning (ML) demands continuous adaptation and investment, further intensifying competition.

- Potential threats: New entrants with innovative technologies or business models could disrupt the existing market landscape.

Palantir's ability to maintain its competitive edge through innovation and strategic partnerships is crucial for its future success.

Evaluating Palantir's Future Prospects

Despite the recent decline, several factors suggest that Palantir's long-term prospects aren't necessarily bleak.

Government Contracts and Revenue Streams

Palantir's significant reliance on government contracts is a double-edged sword. While it provides a stable revenue stream, it also exposes the company to changes in government spending priorities. Diversification into the commercial sector is crucial for mitigating this risk.

- Government spending trends: Changes in government budgets and priorities can directly impact Palantir's revenue.

- Commercial sector growth potential: Expanding into the commercial sector can diversify revenue sources and reduce dependence on government contracts.

- New product offerings: Developing new products and services targeting the commercial sector is essential for sustained growth.

The long-term viability of Palantir’s revenue model hinges on its ability to successfully diversify its revenue streams and adapt to evolving government priorities.

Technological Innovation and Product Development

Palantir’s continued investment in research and development (R&D) and its innovation pipeline are critical for maintaining a competitive advantage.

- New technologies: Investment in cutting-edge technologies like AI, ML, and big data analytics is essential to stay ahead of the competition.

- Product enhancements: Continuously improving existing products and adding new features to meet evolving customer needs is crucial for customer retention and growth.

- Artificial intelligence integration: Integrating AI capabilities into its platform can enhance its analytical power and create new opportunities.

- Strategic partnerships: Collaborations with other technology companies can accelerate innovation and expand market reach.

Palantir's ability to deliver innovative solutions and adapt to the rapidly evolving technological landscape will be critical for driving future growth.

Management and Strategic Direction

Effective leadership and a well-defined strategic direction are vital for navigating the challenges and capitalizing on opportunities.

- Leadership changes: Any changes in leadership should be carefully evaluated for their potential impact on the company's strategic direction.

- Strategic initiatives: The success of Palantir's future depends on the effectiveness of its strategic initiatives.

- Investor relations: Strong investor relations are critical for maintaining investor confidence and attracting investment.

- Overall company culture: A positive and innovative company culture can attract and retain top talent.

The competence and vision of Palantir's leadership team will play a crucial role in determining the company's future success.

Conclusion

Palantir's 30% stock decline is attributable to a combination of macroeconomic headwinds, concerns about its financial performance, competitive pressures, and its reliance on government contracts. However, its potential for future growth remains tied to its ability to successfully diversify its revenue streams, continue investing in technological innovation, and effectively execute its strategic plan. While the current market sentiment is negative, a careful analysis suggests that Palantir's long-term prospects are not necessarily doomed.

Call to Action: While Palantir's recent stock performance has been challenging, a thorough analysis suggests that its long-term prospects remain dependent on several key factors. Further monitoring of Palantir's financial reports, technological advancements, and overall market trends is crucial for investors to make informed decisions about their Palantir investments. Continue your analysis of Palantir stock and stay informed on this dynamic company’s journey. Keywords: Palantir investment, Palantir stock analysis, Palantir future prospects, Palantir stock price.

Featured Posts

-

Understanding The Celebrity Antiques Road Trip Format And Its Appeal

May 10, 2025

Understanding The Celebrity Antiques Road Trip Format And Its Appeal

May 10, 2025 -

Indias Stock Market Today Choppy Trading Despite Flat Close

May 10, 2025

Indias Stock Market Today Choppy Trading Despite Flat Close

May 10, 2025 -

Analyzing The Rhetoric Surrounding Trumps Transgender Military Policy

May 10, 2025

Analyzing The Rhetoric Surrounding Trumps Transgender Military Policy

May 10, 2025 -

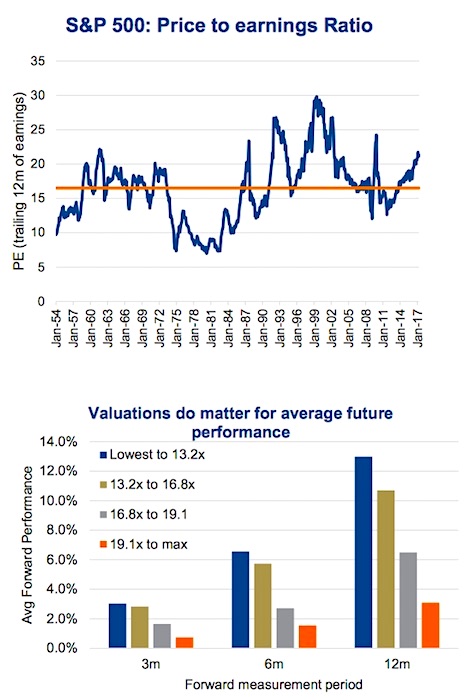

Bof As View Addressing Investor Concerns About High Stock Prices

May 10, 2025

Bof As View Addressing Investor Concerns About High Stock Prices

May 10, 2025 -

Navigating High Stock Market Valuations Advice From Bof A

May 10, 2025

Navigating High Stock Market Valuations Advice From Bof A

May 10, 2025