Billions In Bitcoin And Ethereum Options Expire: Market Volatility Expected

Table of Contents

The Scale of Expiring Options Contracts

The sheer volume of Bitcoin and Ethereum options contracts nearing their expiration date is unprecedented. The total value of these contracts, measured in billions of US dollars, signifies the magnitude of this event and its potential to significantly influence crypto prices. This massive influx of supply and demand in a relatively short timeframe can easily lead to significant price fluctuations.

-

Bitcoin Options: Estimates suggest that over $X billion in Bitcoin call options are expiring, representing a substantial amount of potential buying pressure. Simultaneously, $Y billion in Bitcoin put options are also set to expire, indicating potential selling pressure.

-

Ethereum Options: The situation is similarly significant for Ethereum, with estimates showing $Z billion in Ethereum call options and $W billion in Ethereum put options expiring. This represents a significant increase in open interest compared to previous quarters, amplifying the potential for market movement.

-

Overall Crypto Options Market: The combined value of expiring Bitcoin and Ethereum options, along with other crypto options contracts, paints a clear picture of a volatile period ahead for the entire crypto market. This is further compounded by the increased activity in the derivatives market, showing a general expectation of price swings in the coming days.

Potential Market Impact of Expiring Options

The simultaneous expiry of numerous Bitcoin and Ethereum options contracts has the potential to trigger significant price swings in both cryptocurrencies. This occurs because many traders will need to either buy or sell the underlying assets (Bitcoin or Ethereum) to cover their positions, generating substantial buying or selling pressure depending on the balance of calls and puts.

-

Short Squeezes and Liquidations: A high concentration of expiring call options could lead to a short squeeze, driving the price upwards rapidly. Conversely, a large number of expiring put options could trigger widespread liquidations, resulting in sharp price declines.

-

Market Maker Adjustments: Market makers, who provide liquidity to the options market, will also need to adjust their positions, potentially exacerbating price movements. They might increase their hedging positions, leading to amplified volatility in the cryptocurrency market.

-

Overall Market Sentiment: The outcome of this options expiration event will heavily influence overall crypto market sentiment. A smooth expiration with limited price swings could boost confidence, while significant volatility could trigger a broader sell-off or panic buying.

Factors Influencing Price Volatility Beyond Options Expiration

While the expiring options contracts are a major factor, several other market forces will contribute to the overall price volatility of Bitcoin and Ethereum during this period.

-

Regulatory Developments: Regulatory announcements from major jurisdictions can significantly impact crypto prices. Uncertainty around regulations often leads to increased volatility.

-

Macroeconomic Conditions: Global macroeconomic factors, such as inflation, interest rates, and overall economic growth, heavily influence investor sentiment and risk appetite, impacting both traditional and crypto markets.

-

Adoption Rates and Technological Advancements: Increased adoption of cryptocurrencies by institutions and individuals, as well as significant technological advancements within the Bitcoin and Ethereum ecosystems, can lead to price increases.

-

Major Institutional Investment Activity: Large-scale institutional investment in Bitcoin and Ethereum can either boost or depress prices depending on the nature of the investment (buying or selling pressure).

The interplay of these factors with the options expiration event will determine the ultimate impact on crypto price volatility.

Strategies for Navigating the Volatility

Navigating the potential volatility surrounding the Bitcoin and Ethereum options expiration requires a cautious and well-informed approach. Impulsive trading decisions based solely on short-term price fluctuations should be avoided.

-

Thorough Risk Assessment: Before making any trades, conduct a comprehensive risk assessment to determine your risk tolerance and potential losses.

-

Diversification: Diversify your cryptocurrency holdings to mitigate risks. Don't put all your eggs in one basket.

-

Hedging Strategies: Employ hedging strategies to protect against potential losses. This could involve using options themselves to offset potential risks.

-

Stop-Loss Orders: Utilize stop-loss orders to automatically sell your assets if the price falls below a predetermined level, limiting potential losses.

-

Dollar-Cost Averaging: Consider dollar-cost averaging to reduce the impact of short-term price fluctuations. This involves investing a fixed amount of money at regular intervals, regardless of the current price.

Conclusion: Preparing for Volatility in the Bitcoin and Ethereum Options Market

The billions in Bitcoin and Ethereum options expiring represent a significant event with the potential for substantial price volatility. The interaction of this event with broader market factors, including regulatory developments, macroeconomic conditions, and institutional investment activity, will shape the ultimate price action. Employing sound risk management strategies, including diversification, hedging, and stop-loss orders, is crucial for navigating this period. Stay informed about the billions in Bitcoin and Ethereum options expiring and prepare for the expected market volatility. Develop a robust trading plan to mitigate risk and potentially capitalize on opportunities presented by these significant market events. For more information on options trading and risk management strategies, [link to relevant resource].

Featured Posts

-

Grave Pelea Entre Flamengo Y Botafogo La Violencia Se Desata En El Campo Y Vestuarios

May 08, 2025

Grave Pelea Entre Flamengo Y Botafogo La Violencia Se Desata En El Campo Y Vestuarios

May 08, 2025 -

Abc Promo Features Hilarious Tnt Commentary On Jayson Tatum Lakers Vs Celtics

May 08, 2025

Abc Promo Features Hilarious Tnt Commentary On Jayson Tatum Lakers Vs Celtics

May 08, 2025 -

Rogue Comic Preview Ka Zar Faces Danger In The Savage Land

May 08, 2025

Rogue Comic Preview Ka Zar Faces Danger In The Savage Land

May 08, 2025 -

Yevrokubki Detalniy Analiz Matchiv Ps Zh Ta Aston Villi

May 08, 2025

Yevrokubki Detalniy Analiz Matchiv Ps Zh Ta Aston Villi

May 08, 2025 -

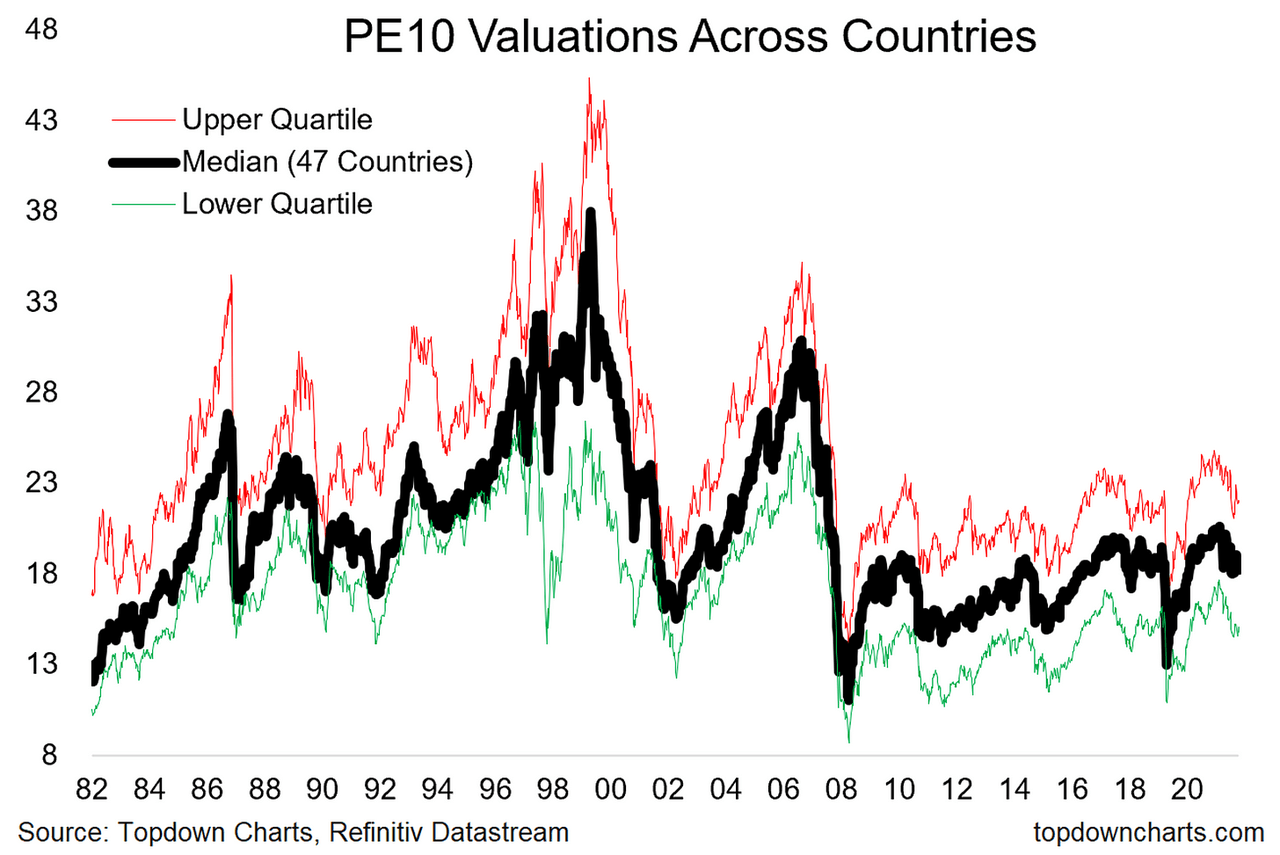

Understanding Stock Market Valuations Bof As Take For Investors

May 08, 2025

Understanding Stock Market Valuations Bof As Take For Investors

May 08, 2025