High Stock Valuations And Investor Concerns: BofA's Analysis

Table of Contents

BofA's Key Findings on High Stock Valuations

BofA's analysis paints a nuanced picture of the current market. While acknowledging the elevated valuations across many sectors, their conclusions aren't simply a blanket statement of "overvalued." Instead, they highlight a complex scenario with varying levels of risk across different asset classes and sectors. The analysis relies heavily on several key valuation metrics to reach its conclusions.

-

Specific valuation metrics used by BofA: BofA employs a range of metrics including the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), and Price-to-Book ratio (P/B) to assess the valuation of various companies and sectors. They analyze these ratios relative to historical averages and compare them across different industries to identify potential overvaluations or undervaluations.

-

Sectors identified as particularly overvalued or undervalued: While specific sectors mentioned in BofA's analysis may change over time (and should be verified with the most current reports), their methodology consistently focuses on identifying sectors exhibiting unusually high or low valuations compared to their historical performance and growth prospects. For example, some technology sectors might consistently show high P/E ratios, while certain cyclical industries might exhibit lower P/E ratios, indicating potential value.

-

Comparison of current valuations to historical averages: A central component of BofA's analysis compares current market valuations to their historical averages. This contextualizes the current levels, highlighting whether current valuations are significantly above or below long-term averages. This helps to gauge whether current prices reflect realistic expectations for future growth or represent a potential bubble.

Investor Concerns Stemming from High Stock Valuations

The elevated stock valuations are naturally causing significant concern amongst investors. The potential for substantial losses is a major worry, especially considering the speed at which markets can change.

-

Risk of market correction or crash: High valuations inherently increase the risk of a market correction or even a more significant crash. When valuations become detached from underlying fundamentals, a sudden shift in investor sentiment can trigger a sharp decline in prices.

-

Potential for lower returns compared to historically lower valuations: Investing in a highly valued market generally implies lower potential returns in the future compared to investing when valuations are lower. This is because the potential for future price appreciation is inherently reduced when prices are already high.

-

Increased vulnerability to economic downturns: Highly valued markets are particularly vulnerable to economic downturns. Negative economic news or unexpected events can trigger a sharp sell-off, leading to significant losses for investors.

-

The impact of rising interest rates on stock valuations: Rising interest rates often lead to decreased stock valuations. Higher rates make bonds more attractive, diverting investment away from the stock market and increasing borrowing costs for companies.

BofA's Recommendations for Navigating High Stock Valuations

BofA's analysis isn't just about highlighting the risks; it also provides strategic recommendations for investors.

-

Diversification strategies (across sectors, asset classes): Diversification remains a cornerstone of sound investment strategy, particularly in periods of high valuations. Spreading investments across various sectors and asset classes (stocks, bonds, real estate, etc.) can help mitigate risk.

-

Focus on value investing principles: Value investing, which focuses on identifying undervalued companies with strong fundamentals, can be a particularly effective strategy in a highly valued market. This approach emphasizes buying assets below their intrinsic value.

-

Importance of long-term investment horizon: Maintaining a long-term investment horizon is crucial. Short-term market fluctuations should not dictate long-term investment decisions. A long-term perspective allows investors to weather market corrections and capitalize on long-term growth opportunities.

-

Potential for specific sectors offering better value: BofA's research might identify specific sectors that appear less overvalued than others, offering better value propositions for investors. This information can guide strategic allocation decisions.

Alternative Investment Strategies

During periods of high stock valuations, exploring alternative investment strategies can be prudent for risk mitigation and portfolio diversification. Alternative investments, such as bonds, real estate, or commodities, can offer different risk-return profiles and potentially lower correlations with the stock market, thereby improving overall portfolio resilience.

Conclusion

BofA's analysis underscores the significant investor concerns surrounding high stock valuations. While not predicting an imminent crash, the analysis highlights the increased risks associated with current market conditions. Understanding these risks and employing strategies like diversification, value investing, and a long-term outlook are crucial for navigating this environment. By carefully considering BofA's findings and conducting your own thorough research, you can better manage your portfolio and make informed investment decisions. Understanding High Stock Valuations is key to successful long-term investing. Consider seeking professional financial advice to tailor a strategy that aligns with your risk tolerance and financial goals and addresses your concerns about managing high stock valuations. Remember, developing effective high stock valuation strategies requires diligent research and careful consideration of your individual circumstances.

Featured Posts

-

Analysis Of Musks X Debt Sale Impact On Company Financials

Apr 29, 2025

Analysis Of Musks X Debt Sale Impact On Company Financials

Apr 29, 2025 -

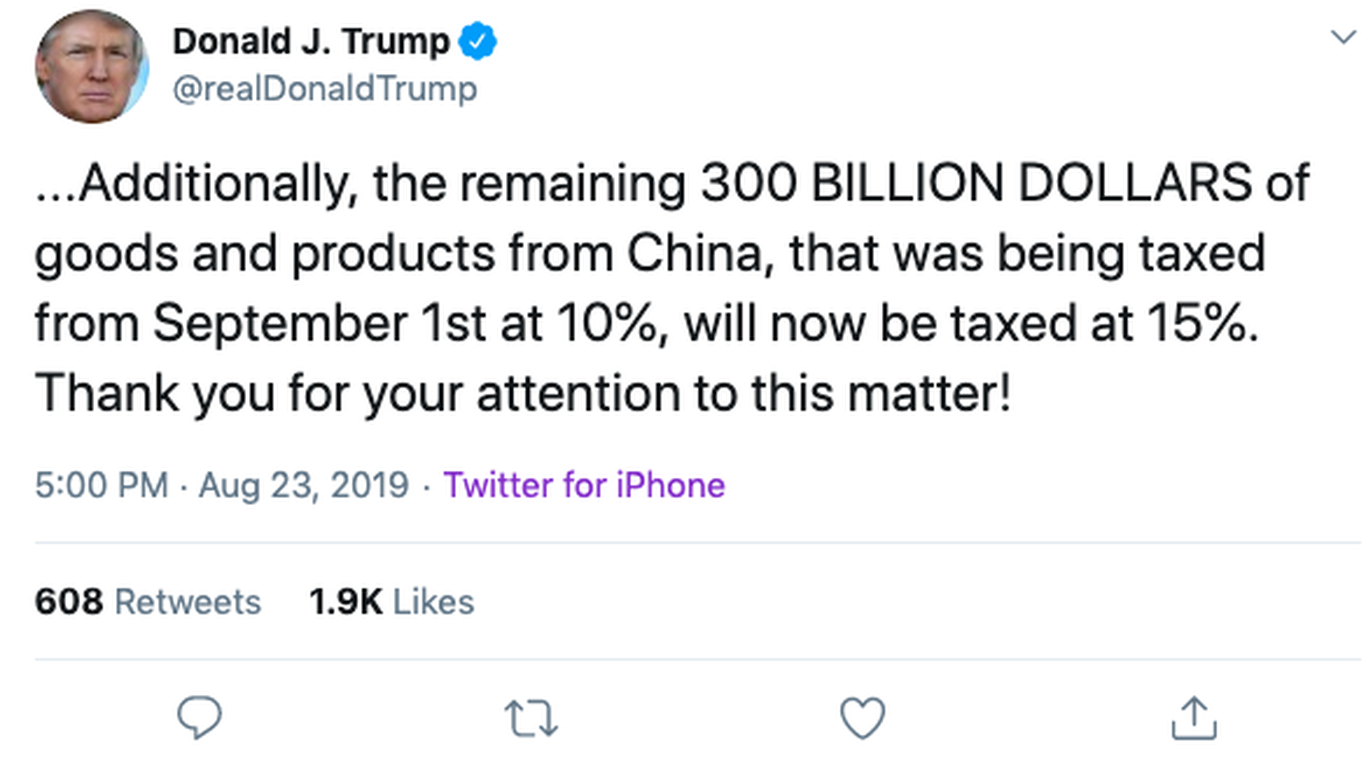

The Long Term Consequences Of Trumps China Tariffs On Us Economic Growth

Apr 29, 2025

The Long Term Consequences Of Trumps China Tariffs On Us Economic Growth

Apr 29, 2025 -

Examining The Inflationary Pressures From Trumps Tariffs On Chinese Goods

Apr 29, 2025

Examining The Inflationary Pressures From Trumps Tariffs On Chinese Goods

Apr 29, 2025 -

How U S Companies Are Responding To Tariff Uncertainty Through Cost Reduction

Apr 29, 2025

How U S Companies Are Responding To Tariff Uncertainty Through Cost Reduction

Apr 29, 2025 -

Vancouver Festival Hit By Car Crash Injuries Reported Crowd Traumatized

Apr 29, 2025

Vancouver Festival Hit By Car Crash Injuries Reported Crowd Traumatized

Apr 29, 2025

Latest Posts

-

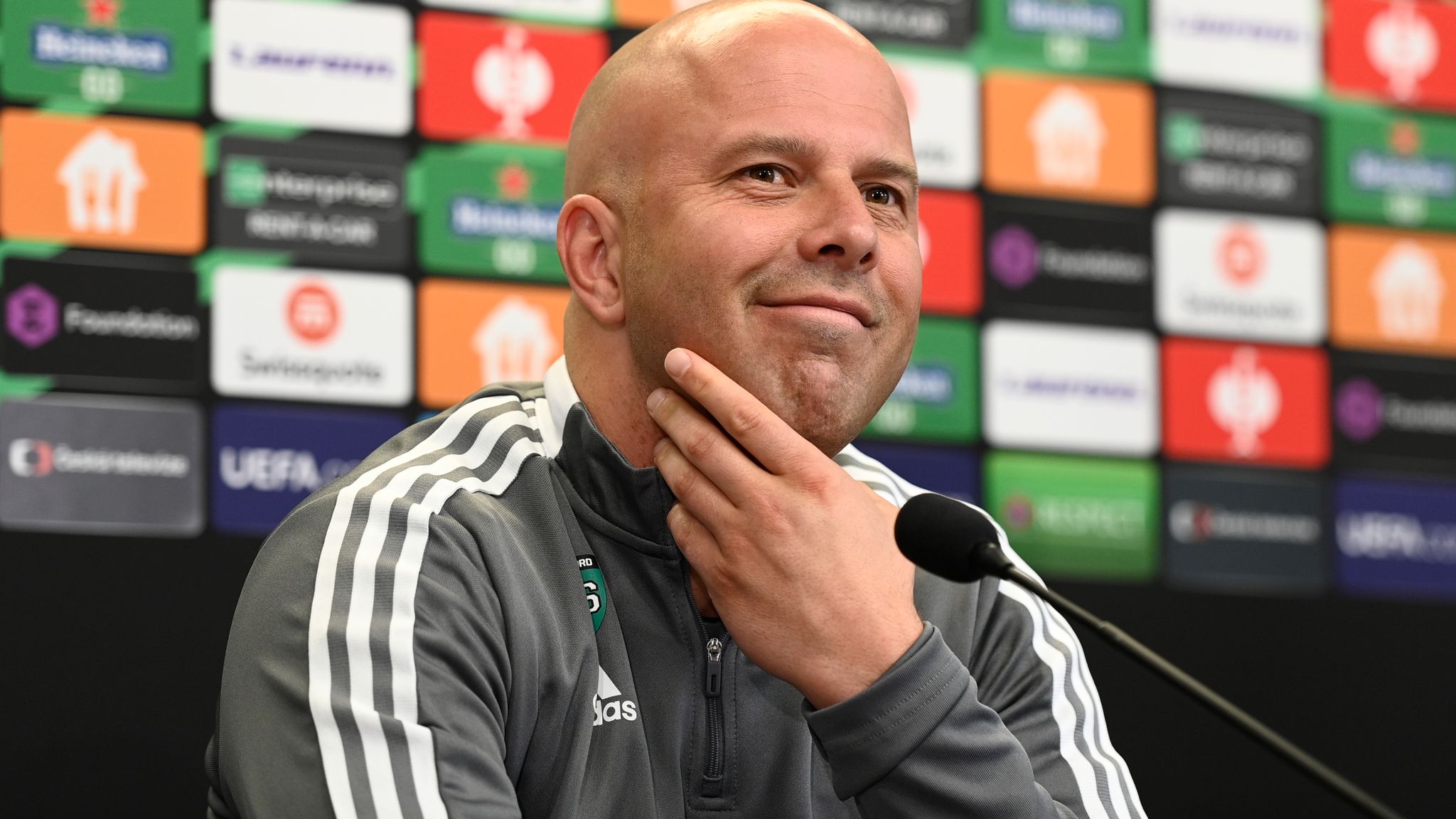

Liverpools Premier League Challenge Arne Slots Impact

Apr 29, 2025

Liverpools Premier League Challenge Arne Slots Impact

Apr 29, 2025 -

Arne Slot The Architect Of Liverpools Almost Triumphant Season

Apr 29, 2025

Arne Slot The Architect Of Liverpools Almost Triumphant Season

Apr 29, 2025 -

How Arne Slot Nearly Delivered Liverpool The Premier League

Apr 29, 2025

How Arne Slot Nearly Delivered Liverpool The Premier League

Apr 29, 2025 -

New Information Surfaces Regarding Helicopter Plane Incident Near Reagan Airport

Apr 29, 2025

New Information Surfaces Regarding Helicopter Plane Incident Near Reagan Airport

Apr 29, 2025 -

Arne Slots Unexpected Liverpool Journey A Premier League Near Miss

Apr 29, 2025

Arne Slots Unexpected Liverpool Journey A Premier League Near Miss

Apr 29, 2025