Opportunistic Investments: Brookfield's Response To Market Dislocation

Table of Contents

Brookfield's Opportunistic Investment Strategy

Brookfield's success in opportunistic investing is rooted in its long-term value investing philosophy. This approach, focusing on fundamental value and long-term growth potential, is ideally suited to navigating the uncertainty and volatility inherent in market dislocations. Unlike short-term traders, Brookfield patiently identifies undervalued assets, often overlooked by others amidst market chaos, and holds them through economic cycles.

Their focus spans diverse sectors, including real estate, infrastructure, renewable energy, and private equity. This diversification mitigates risk and allows them to capitalize on unique opportunities across various asset classes. This strategic approach to opportunistic investing differentiates Brookfield from many competitors.

- Disciplined due diligence process: Brookfield employs rigorous due diligence, ensuring a deep understanding of each asset's potential and associated risks before committing capital.

- Focus on long-term value creation, not short-term gains: Their patience allows them to weather market fluctuations and maximize returns over the long term.

- Deep understanding of market cycles and economic trends: Brookfield's experienced team leverages macroeconomic analysis to identify market inefficiencies and undervalued assets.

- Strong balance sheet and access to capital: Their financial strength allows them to capitalize on opportunities when others are constrained.

- Experienced management team with proven track record: Brookfield’s team possesses decades of experience in identifying and executing successful opportunistic investments.

Case Studies: Successful Opportunistic Investments by Brookfield

Brookfield's history is replete with examples of successful opportunistic investments during market downturns. Their performance during the 2008 financial crisis serves as a prime illustration.

-

Real Estate acquisitions during the 2008 financial crisis: Brookfield capitalized on distressed real estate assets in major markets, acquiring properties at significantly discounted prices. By employing active management strategies, including renovations and repositioning, they significantly increased the value of their portfolio. This resulted in substantial returns exceeding market averages.

-

Infrastructure investments during periods of economic uncertainty: When capital markets tightened, Brookfield saw opportunities in infrastructure projects. Their investments in toll roads, pipelines, and utilities provided stable cash flows, generating strong returns despite economic headwinds. These investments often benefited from long-term contracts and regulated pricing, offering a degree of protection against market volatility.

-

Renewable energy projects during periods of low interest rates: Brookfield strategically invested in renewable energy projects, leveraging low interest rates to secure financing and build large-scale portfolios. These assets benefited from supportive government policies and a growing demand for clean energy, leading to substantial capital appreciation and stable income streams.

Analyzing Brookfield's Competitive Advantages in Opportunistic Investing

Brookfield's success in opportunistic investing isn't accidental; it stems from several key competitive advantages:

-

Extensive global network and local expertise: Their global presence allows them to identify opportunities across diverse markets and leverage local market knowledge to overcome challenges and navigate regulatory complexities.

-

Access to private capital and long-term investment horizons: Unlike publicly traded firms with shorter-term horizons, Brookfield can commit capital for extended periods, weathering market downturns and maximizing long-term value.

-

Strong relationships with financial institutions and government agencies: These relationships provide access to financing and regulatory approvals, facilitating smoother deal execution.

-

Proprietary research and analytics capabilities: Brookfield's advanced analytics enable them to identify undervalued assets and assess risks more accurately than competitors.

-

Ability to leverage operational expertise to improve acquired assets: Beyond financial engineering, Brookfield brings operational expertise to enhance the performance of its assets, boosting profitability and returns.

Risk Management in Opportunistic Investments

Opportunistic investing inherently carries risks. Market downturns can lead to unexpected losses, and even the most thorough due diligence cannot eliminate all uncertainty. Brookfield mitigates these risks through a robust framework:

-

Thorough due diligence and risk assessment: They employ a rigorous process to identify and quantify potential risks before investing.

-

Diversification across asset classes and geographies: This approach spreads risk, reducing the impact of adverse events in any single sector or region.

-

Stress testing investment portfolios against various market scenarios: This helps assess potential losses under different economic conditions and informs investment decisions.

-

Conservative leverage and robust financial planning: Brookfield avoids excessive debt, ensuring financial stability even during market downturns.

Conclusion

Brookfield's success in opportunistic investments stems from a combination of a long-term value investing philosophy, deep market expertise, and a strong risk management framework. Their ability to identify and capitalize on undervalued assets during periods of market dislocation positions them for continued growth in this area of alternative investments. By studying their strategies, other investors can learn valuable lessons in navigating turbulent markets and pursuing high-return opportunistic investments. Explore Brookfield's investor relations materials to learn more about their portfolio and approach to generating alpha through opportunistic investing strategies.

Featured Posts

-

Xrp Etf Prospects Dimmed By Abundant Supply And Limited Institutional Adoption

May 08, 2025

Xrp Etf Prospects Dimmed By Abundant Supply And Limited Institutional Adoption

May 08, 2025 -

2025 Bitcoin Conference In Seoul Key Developments And Trends

May 08, 2025

2025 Bitcoin Conference In Seoul Key Developments And Trends

May 08, 2025 -

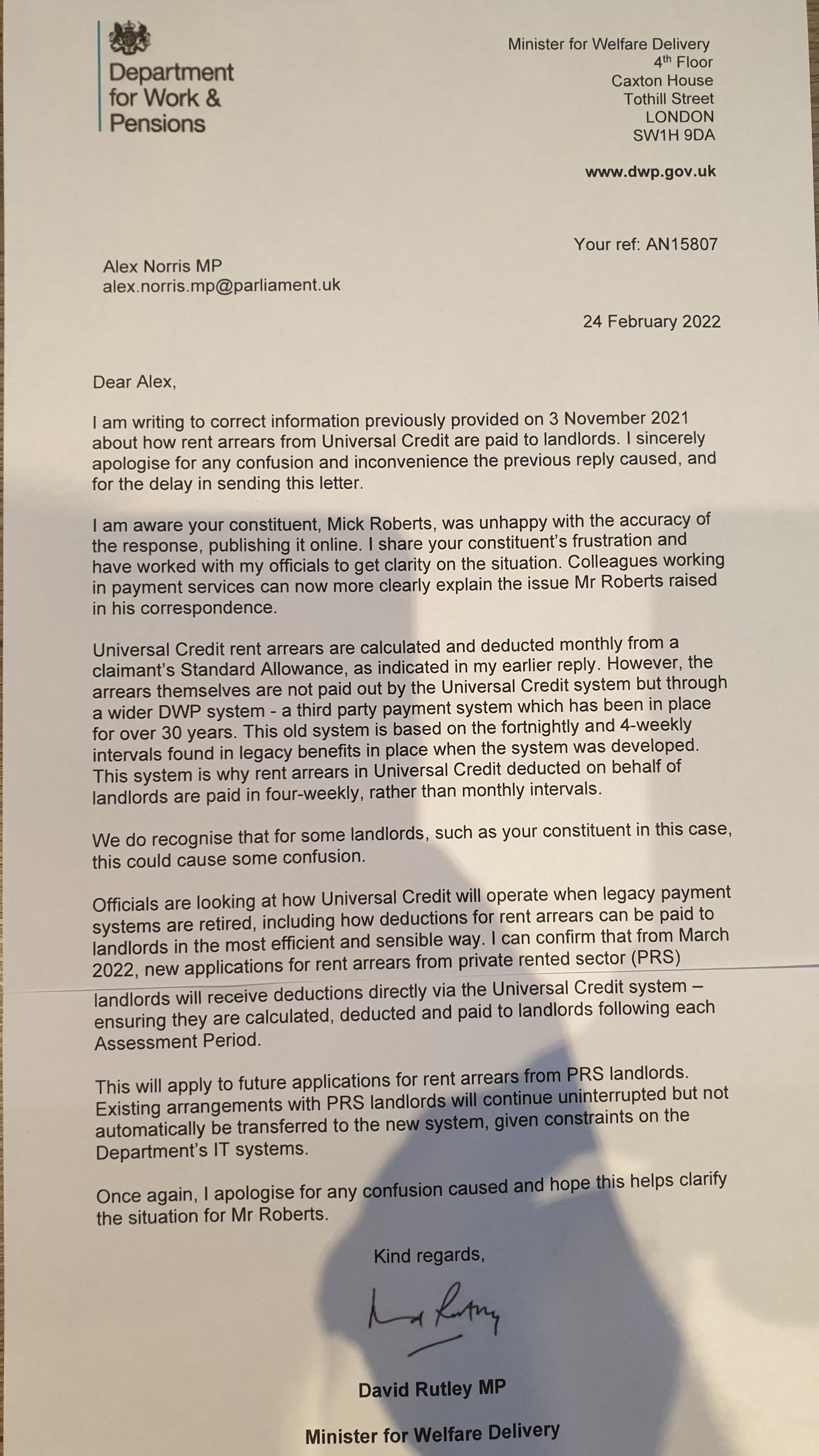

Missed Dwp Letter Understanding The Financial Implications

May 08, 2025

Missed Dwp Letter Understanding The Financial Implications

May 08, 2025 -

Arsenal Ps Zh I Barselona Inter Prognoz Na Polufinaly Ligi Chempionov 2024 2025

May 08, 2025

Arsenal Ps Zh I Barselona Inter Prognoz Na Polufinaly Ligi Chempionov 2024 2025

May 08, 2025 -

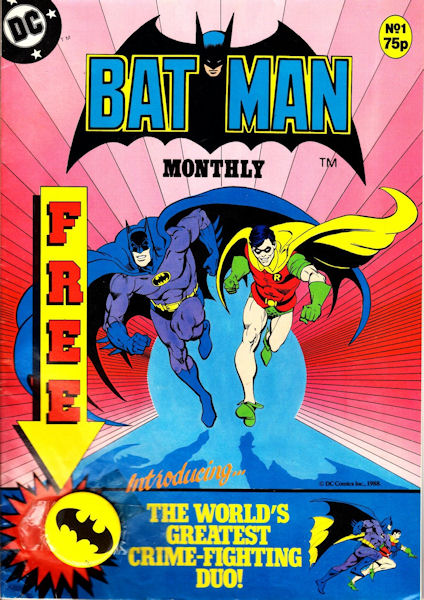

Batman Relaunched New 1 Issue And Costume Unveiled

May 08, 2025

Batman Relaunched New 1 Issue And Costume Unveiled

May 08, 2025