Trade War Intensifies: Amsterdam Stock Market Opens Down 7%

Table of Contents

The Immediate Impact of the Trade War on Amsterdam's AEX Index

The 7% plunge in the Amsterdam Stock Market was a single-day event, witnessed on [Insert Date of Drop Here]. The AEX Index opened at [Opening Value] and closed at [Closing Value], representing a substantial loss for investors. This sharp market decline wasn't isolated to Amsterdam; however, its severity relative to other European indices needs further analysis. While other European markets also experienced losses, the AEX's 7% drop was comparatively significant, reflecting the unique vulnerabilities of the Dutch economy to the current trade disputes.

- Technology Sector: Experienced a [Percentage]% drop, with companies like [Company Name] suffering significant losses.

- Finance Sector: Saw a [Percentage]% decline, impacting major banks and insurance firms.

- Energy Sector: Suffered a [Percentage]% decrease, primarily due to [Specific Reason related to trade war].

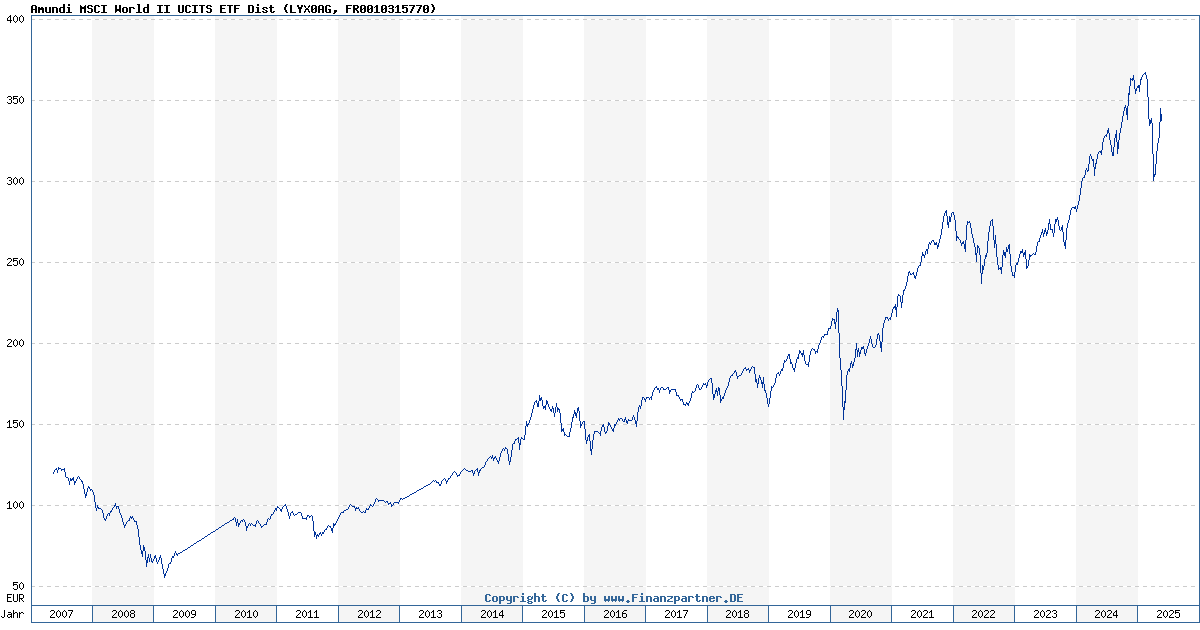

- [Company Name] experienced a [Percentage]% loss, while [Company Name] saw a [Percentage]% decrease. [Include a chart or graph visually representing the AEX Index drop compared to other major European indices.]

This sectoral impact underscores the broad reach of the trade war's effects on the Dutch economy, impacting key players across various industries. The market decline wasn't confined to specific sectors; it represented a widespread loss of investor confidence.

Underlying Causes of the Amsterdam Stock Market Downturn

The Amsterdam Stock Market downturn is primarily attributed to the escalating global trade war. Newly imposed tariffs and trade restrictions, particularly those impacting [Specific goods or sectors affected by trade disputes], have significantly impacted Dutch businesses reliant on international trade. This uncertainty surrounding future trade relations has led to a decline in investor sentiment, making investors hesitant to commit capital.

- Dutch companies heavily reliant on exports to [Specific Countries] are facing significant challenges due to increased tariffs.

- The decline in investor confidence is evident in reduced investment activity and capital flight.

- Economists like [Economist's Name] predict [Economist's prediction regarding future market performance] based on the ongoing trade tensions and global uncertainty.

- The geopolitical risk associated with the trade war, coupled with other global economic factors, further exacerbates the situation.

The economic uncertainty created by the trade war is a primary driver of the current market volatility. The ongoing dispute and lack of clear resolutions are creating a climate of fear and uncertainty.

Potential Consequences and Future Outlook for the Amsterdam Stock Market

The consequences of this stock market crash could be far-reaching. The short-term impact includes reduced consumer spending, decreased investment, and potentially higher unemployment. In the long term, a prolonged period of economic uncertainty could hinder economic growth and negatively impact Dutch GDP.

- A significant decline in exports could lead to a contraction in Dutch GDP.

- The government may respond with stimulus packages or other interventions to mitigate the economic fallout.

- [Expert Opinion on the potential government response, e.g., tax cuts, infrastructure spending].

- Experts predict a [Timeframe] recovery timeline, but this depends largely on the resolution of ongoing trade disputes and the restoration of global investor confidence.

The long-term outlook remains uncertain, and much depends on the trajectory of the trade war and the effectiveness of any government intervention. The potential for further market volatility persists.

Conclusion: Navigating the Uncertainty: Understanding the Amsterdam Stock Market's Response to the Trade War

The 7% drop in the Amsterdam Stock Market represents a significant impact, directly linked to the intensifying global trade war. The underlying causes are multifaceted, including newly imposed tariffs, decreased investor sentiment, and broader geopolitical risk. The potential consequences range from short-term economic slowdown to long-term impacts on Dutch GDP and employment. Navigating this period of Amsterdam Stock Market volatility requires careful monitoring of the ongoing trade war and its implications. Stay informed about developments through reputable financial news sources and consult with a financial advisor to develop an effective investment strategy for managing your portfolio during this period of market uncertainty. Understanding the trade war impact on the Amsterdam Stock Market is crucial for making informed financial decisions.

Featured Posts

-

7 Stock Market Drop In Amsterdam Trade War Uncertainty Creates Volatility

May 25, 2025

7 Stock Market Drop In Amsterdam Trade War Uncertainty Creates Volatility

May 25, 2025 -

Najib Razak French Investigation Links Ex Pm To 2002 Submarine Corruption

May 25, 2025

Najib Razak French Investigation Links Ex Pm To 2002 Submarine Corruption

May 25, 2025 -

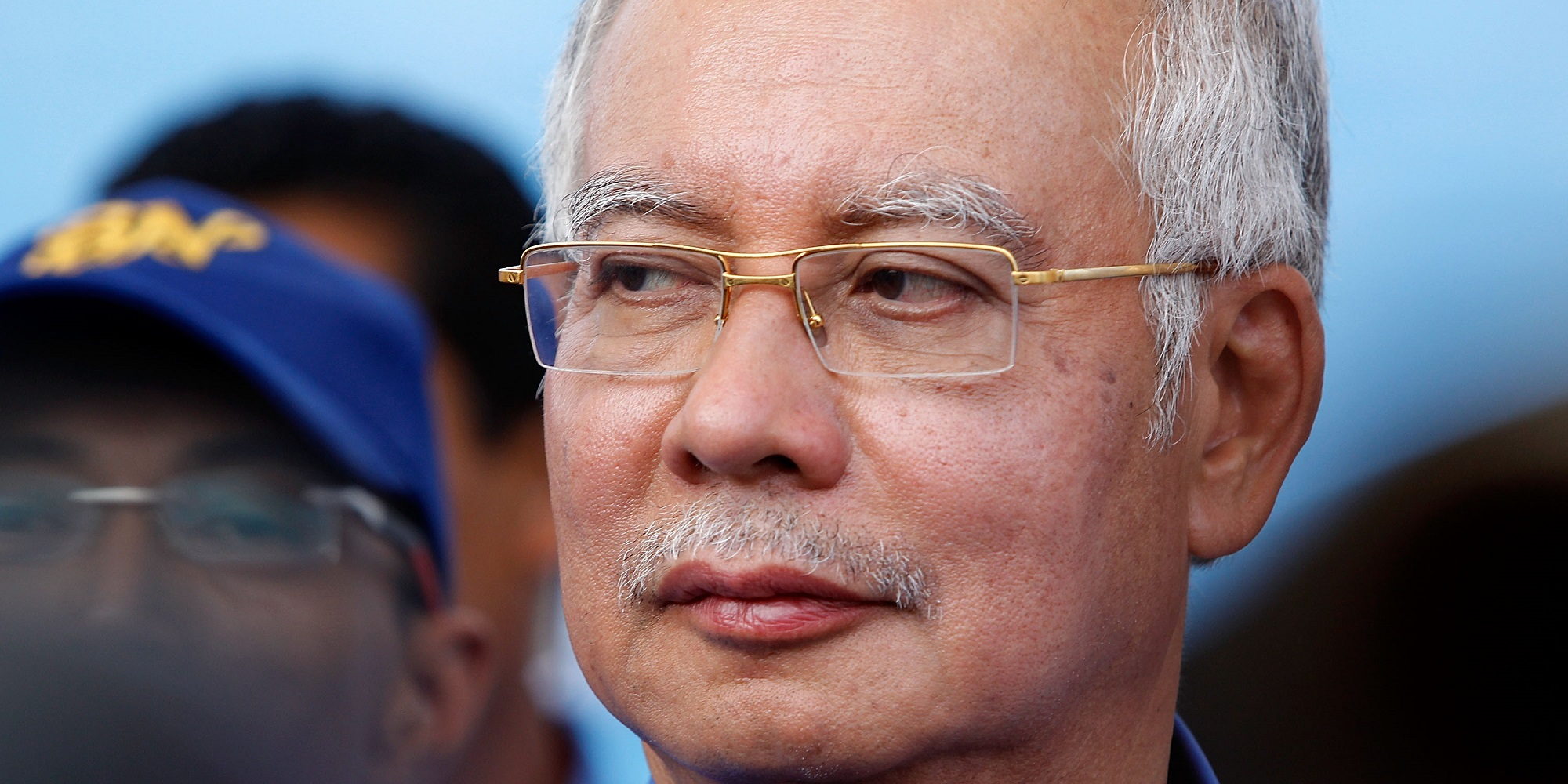

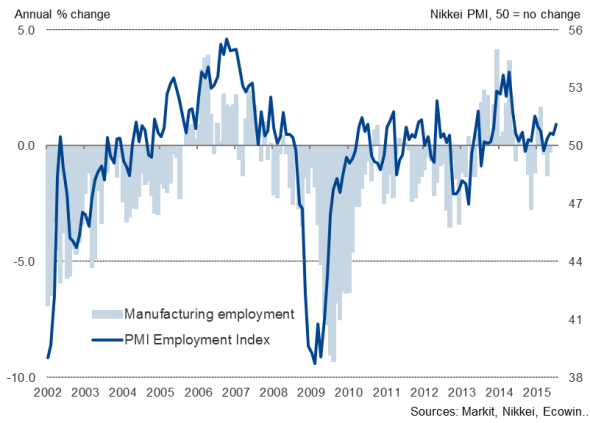

Dow Jones Rallies Pmi Data Fuels Moderate Growth

May 25, 2025

Dow Jones Rallies Pmi Data Fuels Moderate Growth

May 25, 2025 -

Amundi Msci World Ex Us Ucits Etf Acc Understanding Net Asset Value Nav

May 25, 2025

Amundi Msci World Ex Us Ucits Etf Acc Understanding Net Asset Value Nav

May 25, 2025 -

Conflit Ardisson Baffie Essaie De Parler Pour Toi La Reponse Qui A Choque

May 25, 2025

Conflit Ardisson Baffie Essaie De Parler Pour Toi La Reponse Qui A Choque

May 25, 2025