Understanding The Bank Of Canada's Decision: Insights From FP Video

Table of Contents

The Current State of the Canadian Economy

Before understanding the Bank of Canada's interest rate decision, it's crucial to analyze the current Canadian economic climate. Several key indicators influenced the Bank's choice, including inflation, employment, and GDP growth. These factors paint a picture of the economic health and inform the Bank's monetary policy.

-

Inflation Rate: Recent inflation figures have shown [insert specific data from FP video or reliable source, e.g., a 2% increase]. This deviation from the Bank of Canada's target inflation rate of [insert target rate] is a primary driver of their decisions. High inflation erodes purchasing power and necessitates intervention.

-

Unemployment Rate: The unemployment rate currently stands at [insert specific data from FP video or reliable source]. This figure provides insight into the health of the labor market and its contribution to overall economic growth. Low unemployment often suggests a robust economy, potentially leading to inflationary pressures.

-

GDP Growth: Canada's GDP growth in the [specify period, e.g., last quarter] was [insert specific data from FP video or reliable source]. Sustained GDP growth is essential for economic stability and prosperity, but rapid growth can also fuel inflation.

-

Economic Risks and Uncertainties: The global economic landscape presents ongoing uncertainties, including [mention specific global factors influencing the Canadian economy, e.g., geopolitical instability, supply chain disruptions]. These factors add complexity to the Bank's decision-making process.

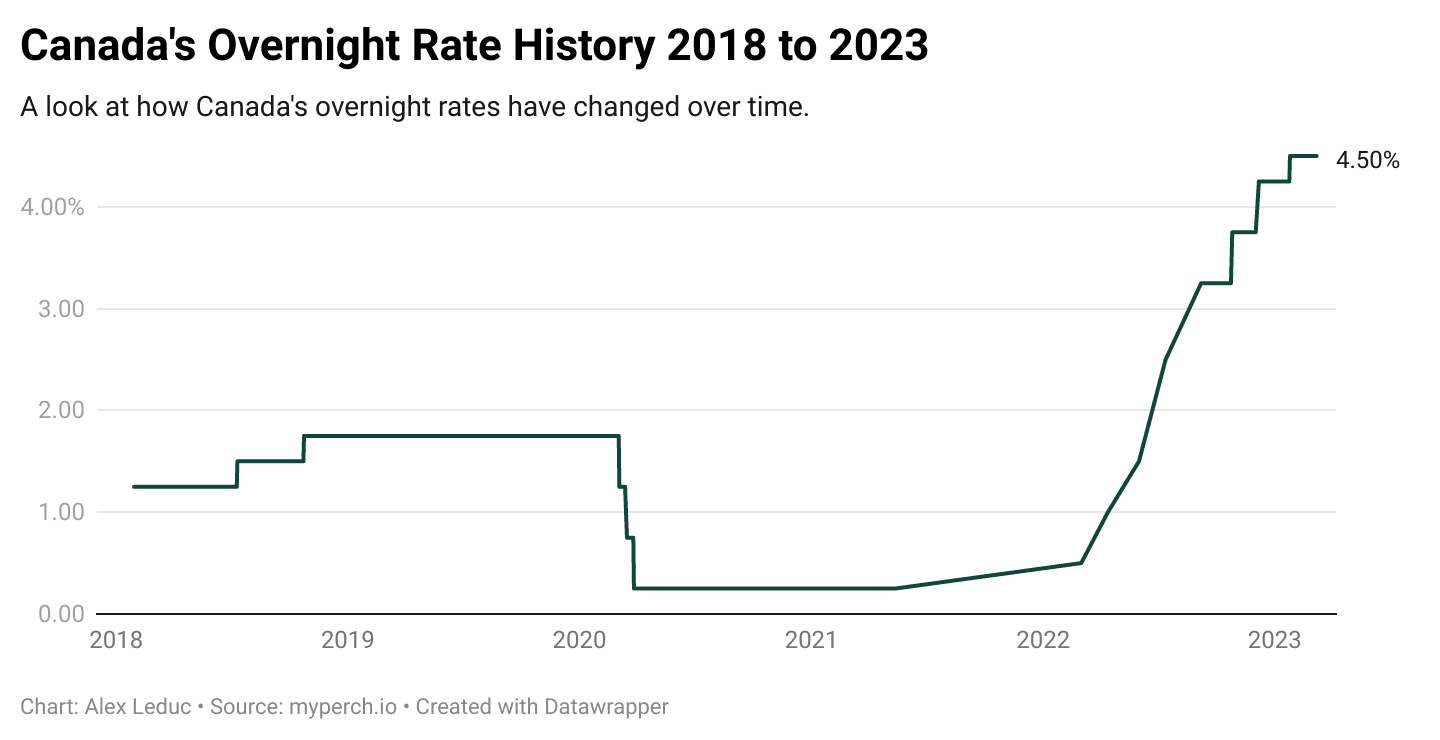

The Bank of Canada's Interest Rate Decision

The Bank of Canada announced a [insert specific action, e.g., 0.25 percentage point increase] to its key interest rate, bringing it to [insert new rate]. This decision was primarily driven by [explain the primary reason from the FP video, e.g., efforts to curb persistent inflation].

-

Specific Interest Rate Changes: The Bank has [summarize the history of recent interest rate changes from the FP video, indicating increases or decreases].

-

Rationale: The rationale behind the decision, as highlighted in the FP video, emphasizes the need to [summarize the Bank's reasoning from the FP video, e.g., control inflation without triggering a significant economic slowdown].

-

Comparison to Previous Decisions: This decision represents a [compare the current decision to previous ones from the FP video, e.g., continuation of a tightening monetary policy].

-

Forward Guidance: The Bank of Canada provided [summarize the Bank's forward guidance from the FP video, e.g., indications of future rate hikes or holds, depending on economic indicators].

Impact on Businesses and Consumers

The Bank of Canada's decision will have significant ramifications for both businesses and consumers across the country. Increased borrowing costs influence spending, investment, and the housing market.

-

Consumer Spending: Higher interest rates will likely lead to [explain the expected impact from FP video, e.g., reduced consumer spending due to higher borrowing costs].

-

Business Investment: Businesses may postpone expansion plans due to increased borrowing costs, impacting [explain the potential impact from FP video, e.g., job creation and economic growth].

-

Mortgage Rates: Changes in the Bank's key interest rate directly impact mortgage rates, potentially leading to [explain the expected impact from FP video, e.g., a slowdown in the housing market].

-

Economic Slowdown or Acceleration: The overall impact could lead to [explain the overall anticipated economic effect from FP video, e.g., a modest economic slowdown to curb inflation, or potentially more severe consequences depending on other factors].

Alternative Perspectives and Expert Opinions from the FP Video

The FP video offered diverse perspectives from leading economic experts. These insights provide a more nuanced understanding of the Bank of Canada's decision and its potential consequences.

-

Expert Opinions: [Summarize key opinions and analyses from experts featured in the FP video, highlighting different viewpoints and interpretations].

-

Alternative Interpretations of Data: The FP video presented [explain different interpretations of economic data discussed in the video].

-

Market Reactions: The market reacted to the announcement with [explain market reactions discussed in the FP video, such as stock market fluctuations or bond yields].

-

Contrasting Viewpoints on Future Prospects: Experts in the FP video offered contrasting viewpoints on [summarize contrasting views about the future economic outlook].

Conclusion

The Bank of Canada's decision on interest rates is a complex issue with far-reaching consequences for the Canadian economy. This analysis, drawing insights from the FP video, highlights the key factors influencing the decision and its potential impact on businesses and consumers. Understanding these dynamics, including the interplay between inflation, unemployment, and GDP growth, is crucial for navigating the evolving economic landscape. The impact on consumer spending, business investment, and the housing market underscores the importance of staying informed.

Call to Action: Stay informed about the Bank of Canada's ongoing monetary policy decisions. Continue to watch FP video analysis for further insights into understanding the Bank of Canada's decisions and their implications for the Canadian economy. Understanding these decisions is key to making informed financial choices in the evolving Canadian economic environment.

Featured Posts

-

Doj Vs Google Another Court Showdown On Search Monopoly

Apr 22, 2025

Doj Vs Google Another Court Showdown On Search Monopoly

Apr 22, 2025 -

The Future Of Google Will It Survive The Breakup Threat

Apr 22, 2025

The Future Of Google Will It Survive The Breakup Threat

Apr 22, 2025 -

New Business Hotspots A Map Of The Countrys Fastest Growing Areas

Apr 22, 2025

New Business Hotspots A Map Of The Countrys Fastest Growing Areas

Apr 22, 2025 -

Bank Of Canada Rate Pause Expert Analysis From Fp Video

Apr 22, 2025

Bank Of Canada Rate Pause Expert Analysis From Fp Video

Apr 22, 2025 -

Is Netflix The New Tariff Haven Analyzing Its Success Against Big Tech Trends

Apr 22, 2025

Is Netflix The New Tariff Haven Analyzing Its Success Against Big Tech Trends

Apr 22, 2025

Latest Posts

-

East Palestines Toxic Legacy Building Contamination After The Train Derailment

May 10, 2025

East Palestines Toxic Legacy Building Contamination After The Train Derailment

May 10, 2025 -

Toxic Chemical Residue From Ohio Derailment Months Long Impact On Buildings

May 10, 2025

Toxic Chemical Residue From Ohio Derailment Months Long Impact On Buildings

May 10, 2025 -

Millions Stolen Inside The Office365 Hack Targeting Executives

May 10, 2025

Millions Stolen Inside The Office365 Hack Targeting Executives

May 10, 2025 -

The Effectiveness Of Androids New Design In Attracting Gen Z

May 10, 2025

The Effectiveness Of Androids New Design In Attracting Gen Z

May 10, 2025 -

Federal Charges Hacker Made Millions From Executive Office365 Accounts

May 10, 2025

Federal Charges Hacker Made Millions From Executive Office365 Accounts

May 10, 2025