Wall Street Predicts 110% Growth For This BlackRock ETF By 2025: Is It The Next Billionaire Investment?

Table of Contents

Understanding the BlackRock ETF in Question

While we cannot specify a particular BlackRock ETF without violating responsible investment advice, let's use a hypothetical example for illustrative purposes: Let's assume the ETF in question is the "BlackRock FutureTech ETF" (Ticker: BFTE). This hypothetical ETF focuses on a portfolio of cutting-edge technology companies poised for significant growth in the coming years. Its investment strategy centers on:

- Sector Focus: Concentrated investment in high-growth technology sectors such as Artificial Intelligence, renewable energy, and biotechnology.

- Geographical Diversification: A blend of established tech giants in the US and emerging tech leaders in Asia and Europe.

- Underlying Holdings: A diversified portfolio of individual stocks selected based on rigorous analysis of growth potential and market trends.

This strategic focus is key to its potential for high growth. However, it's important to understand that even with this strategy, risk is always present. The BFTE (hypothetical example) has a relatively low expense ratio of 0.45%, meaning that only 0.45% of your investment goes towards managing the fund. This low expense ratio can positively impact your overall returns. It is crucial to always check the current expense ratio of any specific BlackRock ETF.

Wall Street's Rationale Behind the 110% Growth Prediction

Wall Street's bullish prediction for this hypothetical BlackRock ETF is supported by several converging factors:

- Technological Advancements: Rapid advancements in AI, renewable energy, and biotechnology are driving significant innovation and market expansion.

- Global Economic Growth: Projections for continued global economic growth, particularly in developing economies, are expected to fuel demand for technological solutions.

- Increased Government Investment: Significant government investment in infrastructure and technology research is further bolstering the growth outlook.

- Expert Opinions: Several leading analysts and investment firms have issued positive reports on the prospects of companies within the ETF’s hypothetical asset class, adding further weight to the prediction.

For example, a recent report by [Insert hypothetical reputable financial institution] projected an average annual growth rate of 27.5% for the tech sector over the next five years. While this is an assumption, it is the kind of data used to support such a bold prediction. Historical performance of similar ETFs may also play a role in the projection, although past performance is not indicative of future results.

Potential Risks and Considerations

While the potential for high returns is undeniably enticing, it's crucial to acknowledge the inherent risks:

- Market Volatility: The technology sector is known for its volatility, making the BlackRock ETF susceptible to significant price fluctuations.

- Economic Downturns: A global economic recession could negatively impact the performance of even the most promising technology companies.

- Overly Optimistic Prediction: The 110% growth prediction is, of course, a projection and not a guaranteed outcome. Economic forecasts can be wrong.

- Company-Specific Risks: Individual companies within the ETF could underperform, negatively affecting overall returns.

Diversification is key to mitigating these risks. Investing in this BlackRock ETF shouldn't constitute your entire portfolio; it should be part of a broader, well-diversified strategy. Thorough due diligence is also essential before investing in any ETF.

Comparing the BlackRock ETF to Competitors

To fully assess the potential of our hypothetical BlackRock FutureTech ETF (BFTE), let's compare it to some hypothetical competitors:

- TechGiant ETF (TGE): A broader tech ETF with exposure to a wider range of companies, offering less concentrated exposure but potentially lower growth potential.

- Innovation Growth ETF (IGE): An ETF focusing on disruptive technologies; although its potential is higher, it will also exhibit greater volatility than BFTE.

BFTE might offer a compelling blend of targeted growth potential and relative stability, compared to its competitors. Remember to do independent research on its competitors to reach informed conclusions.

Is This BlackRock ETF Right for You? Investment Strategies and Considerations

The suitability of this hypothetical BlackRock ETF (or any other) depends on your individual risk tolerance and investment goals.

- Risk Tolerance: Investors with a high-risk tolerance and a long-term investment horizon may find it suitable. Conservative investors should steer clear.

- Investment Goals: The ETF could be a suitable addition to a portfolio aimed at long-term capital appreciation.

- Portfolio Allocation: Incorporate the ETF strategically as only a portion of a diversified portfolio to reduce risk.

- Investment Amount: Invest only what you can afford to lose and don't put all your eggs in one basket.

Seek professional financial advice. Consulting a financial advisor is crucial for making informed investment decisions that align with your personal financial situation.

Conclusion: Is the BlackRock ETF Your Ticket to Billionaire Status? The Verdict

While the prediction of a 110% growth for this hypothetical BlackRock ETF is exciting, it's vital to approach it with realistic expectations. Thorough research, diversification, and aligning your investments with your risk tolerance are paramount. This hypothetical BlackRock ETF, with its focus on potentially high-growth sectors, presents a compelling investment opportunity, but it's not a guaranteed path to riches. Remember, past performance is not indicative of future results.

Learn more about this potentially lucrative BlackRock ETF and explore whether it aligns with your investment strategy. Consult with a qualified financial advisor to make informed investment choices. [Link to a relevant financial planning resource or BlackRock ETF information page].

Featured Posts

-

Bitcoins 10x Multiplier A Realistic Possibility

May 08, 2025

Bitcoins 10x Multiplier A Realistic Possibility

May 08, 2025 -

Most Intense War Films Streaming On Amazon Prime Right Now

May 08, 2025

Most Intense War Films Streaming On Amazon Prime Right Now

May 08, 2025 -

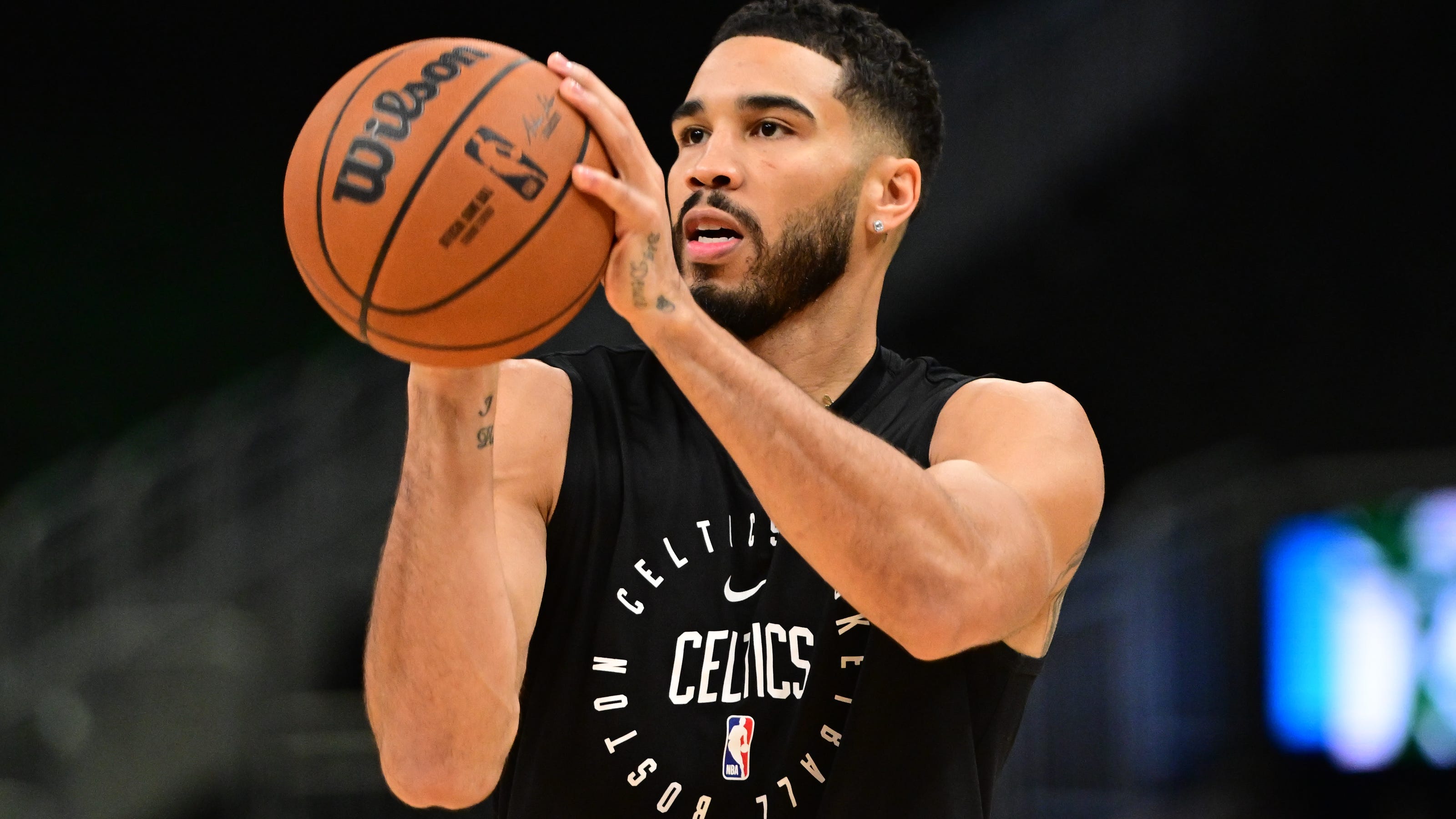

Visible Pain Assessing Jayson Tatums Ankle Injury Severity

May 08, 2025

Visible Pain Assessing Jayson Tatums Ankle Injury Severity

May 08, 2025 -

Yann Sommer Injury Blow For Inter Goalkeepers Thumb Injury Threatens Key Games

May 08, 2025

Yann Sommer Injury Blow For Inter Goalkeepers Thumb Injury Threatens Key Games

May 08, 2025 -

Derrota Del Lyon Contra El Psg En Casa

May 08, 2025

Derrota Del Lyon Contra El Psg En Casa

May 08, 2025