Why Current Stock Market Valuations Are Not A Cause For Investor Concern (BofA)

Table of Contents

The Importance of Context in Evaluating Stock Market Valuations

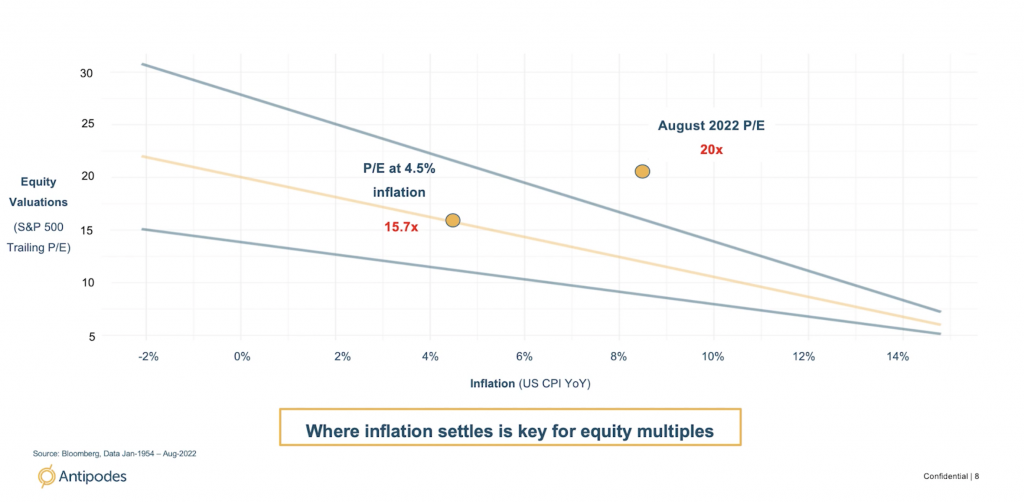

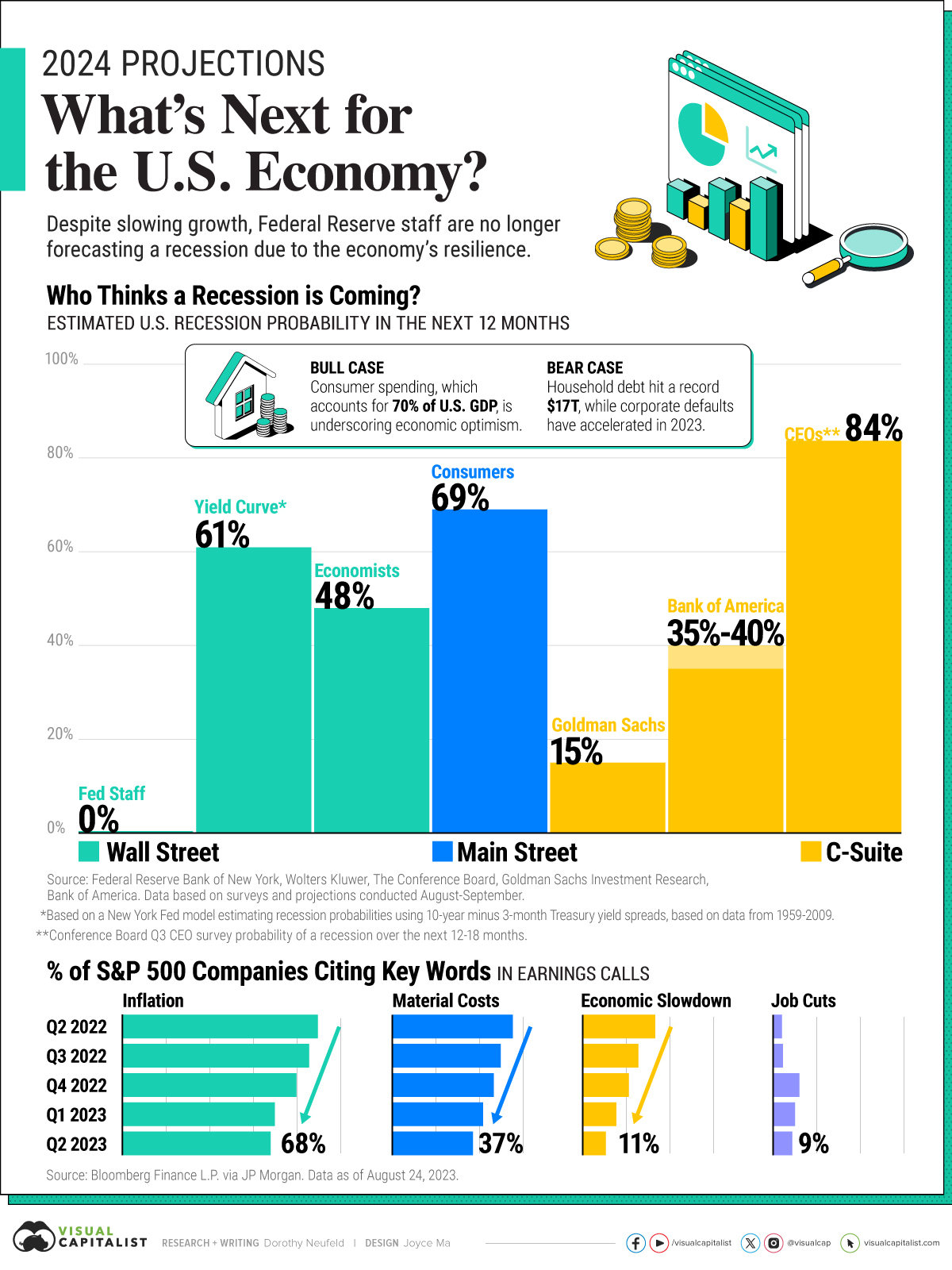

Simply looking at headline valuation metrics like the price-to-earnings (P/E) ratio can be misleading. A comprehensive analysis requires considering the broader economic context and the underlying fundamentals driving corporate performance.

Considering the Low Interest Rate Environment

Historically low interest rates significantly impact equity valuations. Lower interest rates reduce the discount rate used in present value calculations, making future earnings appear more valuable today. This, in turn, justifies higher price multiples.

- Lower discount rates inflate valuation multiples: A lower discount rate applied to future cash flows results in higher present values, leading to higher P/E ratios, Price-to-Book (P/B) ratios, and other valuation multiples. For example, a company with projected earnings far into the future will have a higher present value of those earnings if the discount rate is lower.

- Quantitative easing (QE) and other monetary policies: Central banks' actions, such as QE, have injected liquidity into the market, further supporting asset prices, including equities. This abundant liquidity lowers borrowing costs, stimulating economic activity and boosting corporate profits, which in turn affects valuation multiples.

- Historical comparisons: Examining periods with similarly low interest rates reveals comparable valuation levels, suggesting that current valuations are not entirely unprecedented within a specific historical context.

The Role of Strong Corporate Earnings Growth

Robust corporate earnings growth provides a strong foundation for current stock market valuations. Many companies have demonstrated impressive profit expansion in recent years.

- Data on recent earnings growth: Analysis across various sectors reveals sustained earnings growth, exceeding expectations in many cases. This growth is not solely concentrated in the tech sector but is evident across multiple industries.

- Driving factors: This strong performance is fueled by several factors, including technological advancements that drive efficiency and create new markets, globalization enabling access to wider customer bases, and innovative business models.

- Justification for higher P/E ratios: Sustained earnings growth justifies higher P/E ratios, as investors are willing to pay a premium for companies exhibiting consistent profitability and future growth potential.

Accounting for Future Growth Potential

Valuation analysis must consider future growth expectations. Focusing solely on current earnings overlooks the potential for significant future expansion.

- Innovation and technology: The transformative power of emerging technologies like AI, cloud computing, and biotechnology promises to significantly impact future earnings across various sectors.

- Demographic shifts and global economic expansion: Demographic trends, such as a growing middle class in emerging markets, contribute to increased demand and economic growth, further fueling corporate profits.

- Discounted cash flow (DCF) models: Sophisticated valuation models like DCF analysis explicitly incorporate projections of future cash flows, offering a more nuanced assessment of intrinsic value compared to simple ratios.

Addressing Specific Valuation Metrics and Their Limitations

While P/E ratios are widely used, relying solely on them can be inaccurate. A broader perspective encompassing other key metrics is necessary.

Beyond Simple Price-to-Earnings Ratios

The limitations of P/E ratios are numerous. Using only one metric creates an incomplete picture.

- Other key valuation ratios: A comprehensive evaluation requires incorporating metrics such as Price-to-Book (P/B), Price-to-Sales (P/S), and Enterprise Value to EBITDA (EV/EBITDA) ratios.

- More comprehensive picture: These ratios offer different perspectives on valuation, reflecting various aspects of a company's financial health and growth prospects. A balanced approach considers them all.

- Different interpretations: Different metrics can yield varying interpretations. For example, a high P/E ratio might be justified by strong future growth, while a high P/B ratio might signal overvaluation.

The Influence of Market Sentiment and Investor Behavior

Market psychology plays a significant role, and short-term fluctuations often outweigh the fundamentals.

- Herd behavior and market bubbles: Investor behavior, including herd mentality, can create market bubbles where valuations detach from intrinsic value. This irrational exuberance can lead to short-term distortions.

- Fear and greed: Emotions like fear and greed influence market sentiment, creating volatility and affecting valuations temporarily. Rational investors should avoid being overly swayed.

- Importance of long-term strategies: Long-term investment strategies help mitigate the impact of short-term market fluctuations and emotional biases.

BofA's Investment Strategy Recommendations Based on Current Valuations

BofA's analysis suggests specific strategic approaches based on their evaluation of the current market.

Sector-Specific Opportunities

BofA identifies several sectors as potentially undervalued or poised for strong growth.

- Specific examples and rationale: [Insert specific sectors BofA recommends and provide a brief explanation for each, highlighting their growth potential and relative valuation.] For example, the renewable energy sector might be highlighted due to the growing demand for sustainable energy solutions.

- Long-term return potential: These sectors offer significant potential for long-term returns, justifying strategic allocation within a diversified portfolio.

Risk Management Strategies for Investors

Successful investing involves managing risk effectively.

- Portfolio diversification: Diversification across asset classes and sectors is crucial to mitigate risk and enhance the resilience of your investment portfolio.

- Asset allocation strategies: A well-defined asset allocation strategy, tailored to your risk tolerance and investment goals, is essential for navigating market volatility.

- Risk tolerance assessment: Understanding your personal risk tolerance is fundamental to making informed investment decisions. Avoid investments that cause undue stress or anxiety.

- Long-term investment horizon: Maintaining a long-term investment horizon allows you to ride out short-term market fluctuations and benefit from the power of compounding.

Conclusion

In conclusion, while current stock market valuations may appear high at first glance, a deeper analysis reveals that several contextual factors justify the current levels. The historically low interest rate environment, strong corporate earnings growth, and the potential for future growth all play significant roles. Furthermore, relying solely on simple metrics like the P/E ratio provides an incomplete and potentially misleading picture. BofA's perspective emphasizes the importance of considering a range of valuation metrics and accounting for the influence of market sentiment. By understanding these factors and adopting appropriate risk management strategies, investors can manage their concerns effectively and capitalize on potential opportunities. To understand stock market valuations better and manage your investment concerns effectively, learn more about BofA's perspective on current market valuations by visiting [link to BofA's investment resources].

Featured Posts

-

Federal Government Appoints Anti Vaccination Advocate To Lead Autism Study

Apr 27, 2025

Federal Government Appoints Anti Vaccination Advocate To Lead Autism Study

Apr 27, 2025 -

Simplifying Banking Ecb Establishes New Regulatory Task Force

Apr 27, 2025

Simplifying Banking Ecb Establishes New Regulatory Task Force

Apr 27, 2025 -

Dip Dye Ponytail Trend Ariana Grandes Swarovski Look

Apr 27, 2025

Dip Dye Ponytail Trend Ariana Grandes Swarovski Look

Apr 27, 2025 -

Us Economic Growth To Slow Considerably Deloittes Prediction

Apr 27, 2025

Us Economic Growth To Slow Considerably Deloittes Prediction

Apr 27, 2025 -

Trade War Weighs On Economy Ecbs Simkus Hints At Two More Interest Rate Cuts

Apr 27, 2025

Trade War Weighs On Economy Ecbs Simkus Hints At Two More Interest Rate Cuts

Apr 27, 2025

Latest Posts

-

Posthaste Measuring The Us Economic Fallout From The Canadian Travel Boycott

Apr 28, 2025

Posthaste Measuring The Us Economic Fallout From The Canadian Travel Boycott

Apr 28, 2025 -

Ev Mandate Opposition Intensifies Car Dealers Push Back

Apr 28, 2025

Ev Mandate Opposition Intensifies Car Dealers Push Back

Apr 28, 2025 -

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025 -

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025 -

Individual Charged With Millions In Losses From Office365 Executive Account Hacks

Apr 28, 2025

Individual Charged With Millions In Losses From Office365 Executive Account Hacks

Apr 28, 2025